ZCL.to has some qualities of a good value stock:

- Obscure name

- At or near 52 week low

- Near 5 year low

- Boring industry

- Headquartered here in Edmonton, making scuttlebutt easy

Here’s something to get your blood pumping…

That is a 10 year trading history of ZCL. From over $15 down to around $3 today. Yeah, I know. I was excited too.

I love when a former growth stock disappoints and falls off the map. Top it off with a global recession and an less than liquid shares, and you have the recipe for a deep value investment.

That’s really where the value in ZCL ends.

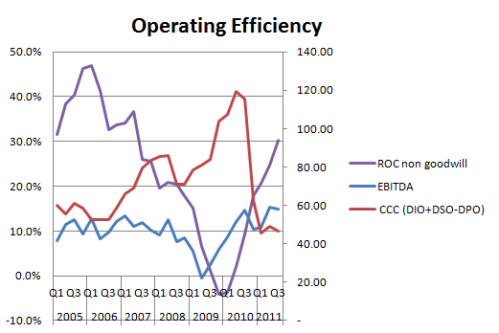

The two charts above show an average company that doesn’t really follow the economic cycle. That by itself isn’t really a worry. If the price is cheap enough, then you can buy almost any company.

There does look to be some mean reversion in margins going on. Though we are a long way from “average”.

My most aggressive fair value is for a return to historical profitability with revenue growth of 10%. This would give ZCL a DCF fair value of $4.50 or so. Current EPV and Graham fair value is $2.00-$3.00. Not enough margin of safety.

If we return to peak Ebitda of 19.3 million (nearly 4x what it is today), we still get a EV/Editda of 5.6x. That’s a lot of growth built in. That’s were the risk is in ZCL.

I would be interested if ZCL starts trading closer to tangible book or has some miraculous run in profitability coupled with a flat share price. Until then, I’ll wait patiently.

Dean